Over the last decade, most of the traders and service providers were in anticipation of an imposition of tax which would enable them to enhance their tax credit and save big on the manufacture to wholesaler to retailer chain. The awaited GST bill was passed by the Rajya Sabha with success.

It is the 122nd Amendment to be carried out under the Constitution of India. It impends approval of the Parliament; if this is forecast with hope then the following changes would take place in the tax regime, between then and now:

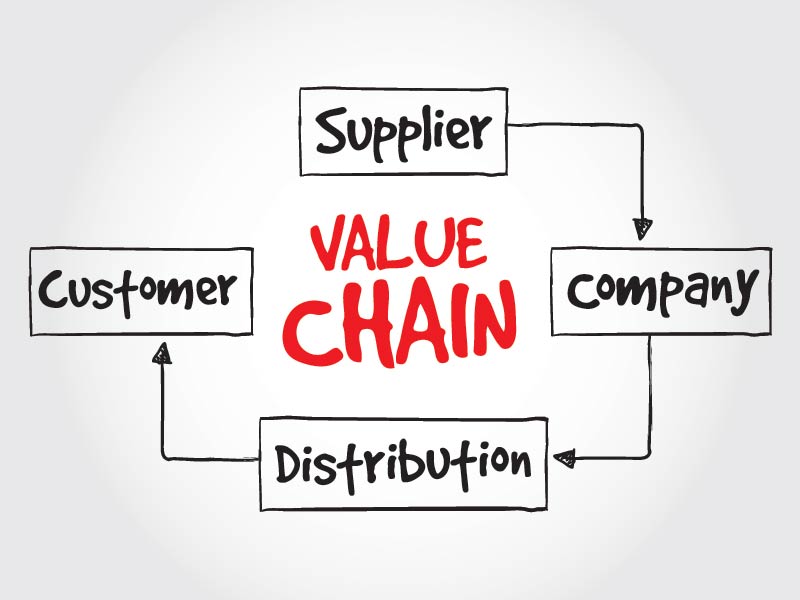

The Value Chain

Manufacture A purchases from Supplier Z, he has to pay amount inclusive of tax. When A develops a product and sells it to Wholesaler B, he has to pay an additional amount of tax on sale of the product, but with the GST, he can set it off against the tax paid to Z. Further, when B adds his margin and sells it to Retailer C, he has to pay tax on resale, but now, he can set it off against the tax paid to B. Thus, at the end of the chain, the total GST would be addition of the tax to Z plus difference amount (set-off) paid by A to B plus difference amount (set-off) paid by B to C.

The amount to be paid by the consumer is relatively lesser than the amount of tax levied on the product, compared to the current regime of Value Added Tax and Service Tax separately. The only ones benefitting from the GST would be the players in the value chain since the consumer has to pay the total amount of tax charged at every stage. Presently, there are no set-offs available on inputs or previous purchases thereby having a cascading effect (tax on tax).

Integrated Tax

The Value Added Tax (VAT) extends to both Central and State Level. CENVAT (Central VAT) has the facility of set-offs only against central excise duty and service tax paid up to the level of production but does not extend to value addition by the distributive trade below the stage of manufacturing; even manufacturers cannot claim set-off against other central taxes such as additional excise duty and surcharge. Similarly, VAT within states does awards benefit to sellers to claim tax credit only on previous purchases but other heavy taxes are imposed on luxurious goods, octroi, and entertainment activities.

After the GST is implemented, both the central level taxes and the state level taxes including the taxes on goods and services will be integrated into one mechanism purporting the GST on Central level and State level separately. With this, there will be tax levied on value addition at each stage, enabling the manufacturer/seller at every stage to set off his taxes against the central/state GST paid on his purchases. The consumer will bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages.

Taxes To Be Substituted with Central GST

- Central Excise Duty

- Duties of Excise

(Medicinal and toilet preparations) - Additional Duties of Excise

(goods of special importance) - Additional Duties of Excise

(textiles and textile products) - Additional Duties of Customs

- Special Additional Duty of Customs (SAD)

- Service Tax

- Cess and surcharges

Taxes To Be Substituted with State GST

- State VAT

- Central Sales Tax

- Purchase Tax

- Luxury Tax

- Entertainment Tax

- Entry Tax

- Taxes on advertisements

- Taxes on lotteries, betting and gambling

- State Cess and surcharges

Taxes GST Will Not Affect

Although, excise duty may be imposed on tobacco, tobacco products, it will not have effect on petroleum crude, high speed diesel, motor spirit (petrol), natural gas and aviation turbine fuel, fuel used for marine purposes and alcoholic liquor (not medicinal purposes).

Benefits of GST

It will help expose transactions conducted underground because the general public will prefer purchasing goods and availing services from those who have paid taxes on what is supplied to them at first. In this way, if tax is not paid on resale/sale, the benefit of claiming credit on inputs is devoid.

Industry/sectors Who Will Benefit The Most

FMCGs like Godrej, Hindustan Unilever but will be negative for companies like ITC as they produce cigarettes they would not be covered within the ambit of GST.

The Logistics industry will be benefitted by consolidation of warehouses and increased efficiencies with elimination of central sales tax and inter-state value-added tax. Infrastructure companies like L&T would face relief as GST eliminates the difference between sales and services.

The overall price increase for new residential properties could be marginally lower than that for new commercial properties if one is looking for investing in housing. The additional tax cost is simply passed on to the final consumer (Standard-Rated goods), or is claimed back from the government (Zero-Rated goods). But in this case (Exempt-Rated), the additional tax cost is borne by the party before the final consumer – The developer. The developer does not have a next “victim” in the supply chain.

This seems like good news for home buyers as they do not have to pay GST when purchasing a home. Developers would try to build in the additional tax costs into the final sale price implicitly.

And if you still did not quite understand what it is, we have video by the famous actor Pallavi Joshi, who will explain this in the most simple way. Check it out

Don’t forget to share this post with your network. Join Campus Times Pune on Facebook, Google+ & Twitter. Also do subscribe our YouTube Channel. Click on Push Notifications to get notified whenever we publish a post.

Campus Times Pune is an initiative taken by some enthusiastic students of Pune to entertain the “Netizens” by providing cool and trending content online. Articles from contributors who prefer keeping their identity anonymous, are published under our authorship. You can contact us with your articles by sending them to “911@campustimespune.com”

Great Post ! All the necessary information is given above regarding GST.